The Kelly Criterion was first introduced by J.L. Kelly who was a researcher for Bell Labs in 1956. The idea behind the theorem is to maximize wealth as the number of observations (or bets) goes to infinity. Though originally created for financial portfolios, it has been borrowed by the sports betting community for bet size management.

Making Sense of the Formula

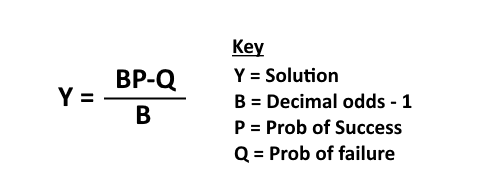

Formula for the Kelly Criterion

Using the Formula in an Example

Let’s say a bettor, we will call him Joey Nevada, has a bankroll of $5,000. He sees that the Packers money line is even money (+100) against a struggling New York Jets team. Joey thinks that the Packers actually have about a 55% chance to beat the Jets in this upcoming game. What should he wager?

First, we will solve for b. +100 in American odds can be converted to 2 in decimal odds. There are a variety of calculators across the internet that will do this math for you, like this one at AceOdds. Since b is the decimal odds minus one, we end up with a b of 1.

Second, we find p and q. We stated that Joey thinks the Packers have a 55% chance to win. Thus, p = 0.55 and q = 0.45.

Third, we plug this all in to find y. y = ( 1 (0.55)-0.45 ) / 1 = 0.1. Ok, so y=0.1, what does that mean? It means that Joey should bet 10% (or 0.1) of his bankroll on the Packers. With a bankroll of $5,000, this means that he should make a $500 bet.

I Hate Math But Like the System. Is There Another Way?

There are some great calculators online that will do all of the math for you. GamedayMath has an awesome kelly criterion calculator that has an adjustable multipler. We also built our own calculator that anyone can use. The latter one is a bit more easy to use with less variables to input into the program.

Final Thoughts on Kelly Criterion

Honestly, we just aren’t huge fans. As mentioned earlier, there is just too much of a drawback in attempting to estimate variables p and q. If those can’t be estimated accurately, then your chances of going bust will happen much more quickly than expected. We think there are a few simple rules that would serve a bettor much better.

a. Play what you are comfortable with.

b. Never play more than 10% of your bankroll on one contest.

c. An average bet (or 1 unit) should be around 2%-5% of your bankroll.

d. Never have more than 50% of your bankroll out at one time as this may be a sign that you are pushing too hard.